TAX TIME 2023

Your 2023 tax refund may be much lower than the past couple of years.

In case you haven’t heard, the government discontinued its low and middle income tax offset (LMITO) as of 30 June 2022.

Therefore, if you have about $1,500 less in your 2023 return refund, compared to last year, the missing LMITO could be the cause.

At DTW Services we can do your 2023 income tax return via email - no visit to our office required*.

*New clients must come into our Muswellbrook office and provide their identification in person.

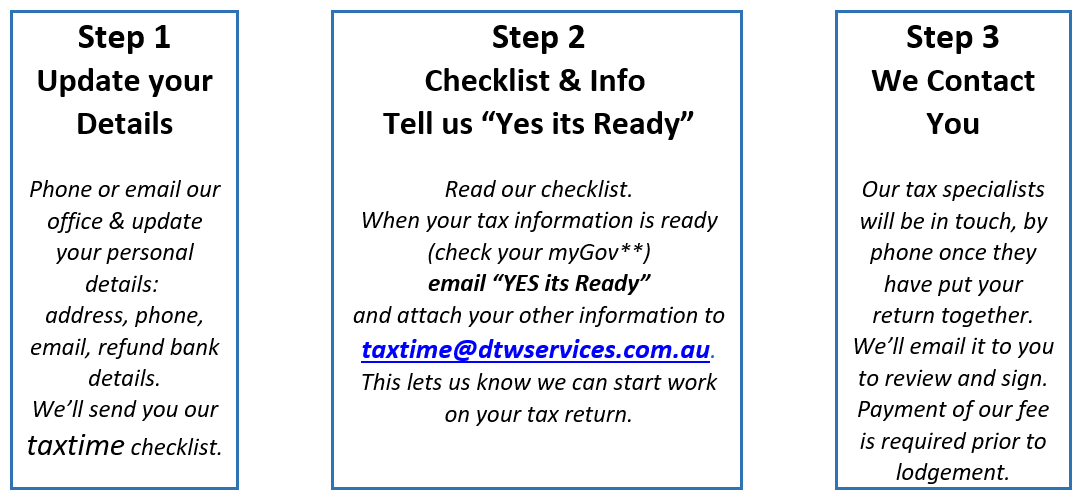

3 Simple Steps - Taxtime

Taxtime Checklist for Individuals

Use our taxtime Individual Tax Return Checklists (Links below) to determine the extra information we may need to complete your tax return.

We will access your information direct from the ATO, however this is not always complete and up to date (especially in July and August).

Therefore, we need you to check your myGov to see if it’s all there or email us original documents.

2023 FYI

Your Finalised PAYG Payment Summary (Employer Group Certificates):

When your end-of-year payment summary is finalised by your employer at the ATO it will be identified as ‘Tax ready’ in your myGov. The ATO will send a notification to you.

**Please wait until it says 'Tax ready' before asking us to complete your return.